Financial Organisation

DIVA Financial coaching and management offers a comprehensive approach to achieving financial independence and breaking free from fear and frustration that hold us back.

Our mission is to assist, guide and educate you, so you can take control of your financial future.

At DIVA Financial, we assist you to navigate and resolve disputes with financial, industrial, government and legal systems, and achieve financial and emotional independence. Besides taxation, book keeping and other financial services, we also offer financial education, especially to the youth. We have dedicated programs for university students and mothers and daughters where they get to know the basics of everyday finance and management in a fun and simple manner.

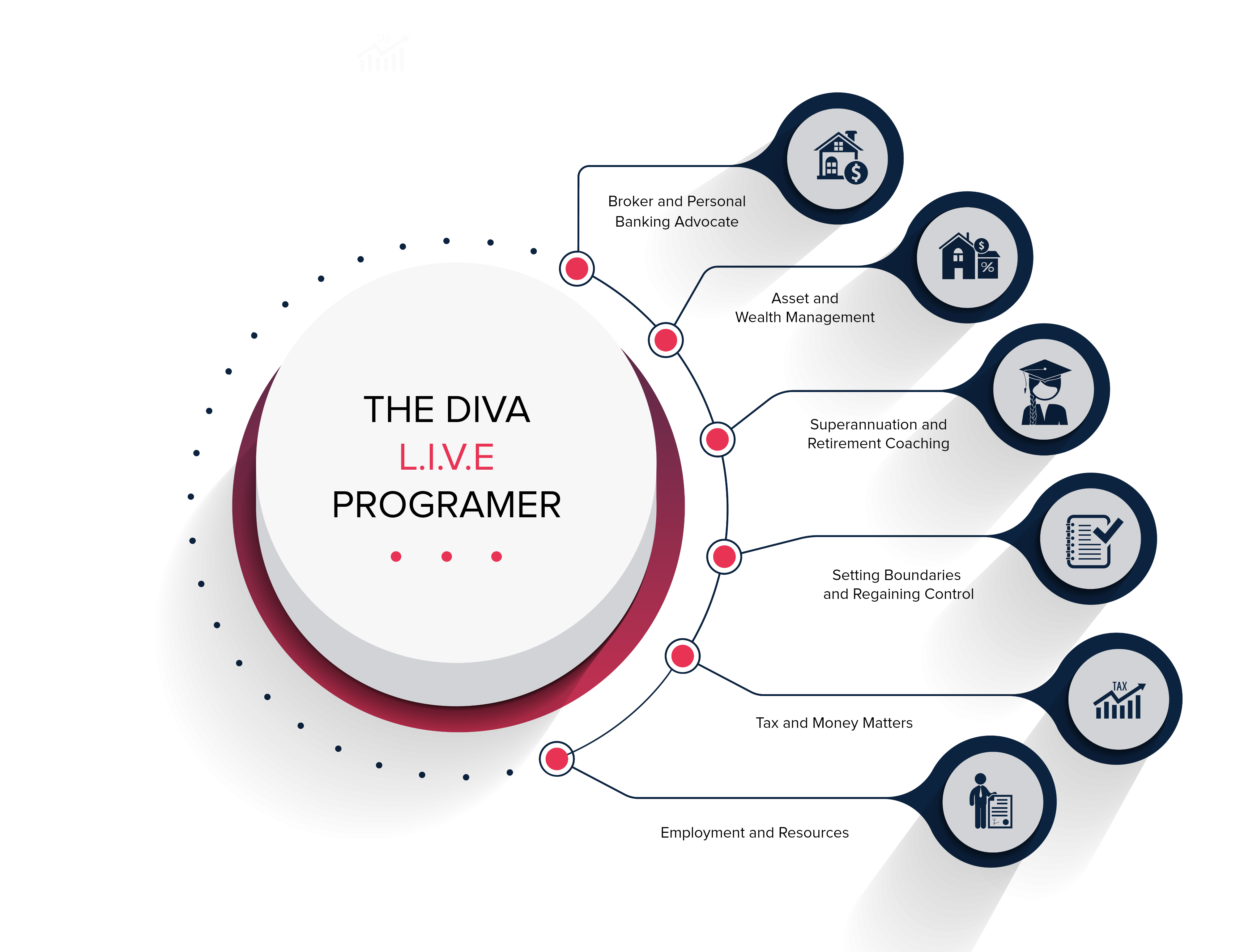

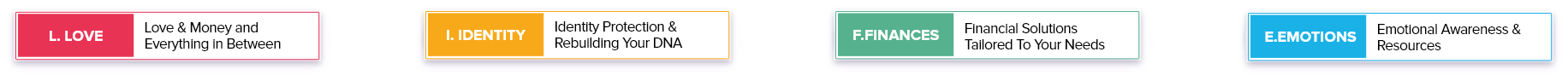

The DIVA

L.I.F.E. Program

Our commitment to helping you reclaim control over L.I.F.E. – Love, Identity, Finances, Emotions – has inspired our focus on six areas in life which lay a foundation for a secure financial future.

Our consultancy will draw on expertise of our team to support and achieve this secure financial future by focusing our support on each of these areas.

Our Workshop

Our workshops cover all aspects of finance from a variety of professionals:

- Giving you knowledge of a range of products and services that help you take control of your superannuation, insurance, personal finances, budgets and succession plans

- Education on structuring your personal and business finances in order to better manage risk and allow you to grow your wealth

- Education to prepare for changes in your personal life and pay for the important things in the future like your children’s education and a home

- Support to manage your finances in the longer term which preempts evolving threats and seize opportunities for growth.

Getting Help And Support For Financial Abuse

If you or someone you know is experiencing financial abuse, free and confidential advice is available as part of Diva’s social enterprise service with DIVA Financial.

If you’re in a crisis or struggling to make ends meet, find out how to get urgent help with money. call 1800RESPECT (1800 737 732) or visit www.1800RESPECT.org.au.

Got a Question?

Anything to do with finance is generally overwhelming and can be confusing. Life happens and we can find ourselves in unfamiliar territory. Or, we can find ourselves facing adversity or hardship and can’t see a way through. Nothing surprises us and there isn’t much we haven’t dealt with, so send your inquiry or make time to talk to us.

How do I know where to start if I am overwhelmed with my situation?

It begins with a conversation similar to catching up with an old friend; one step at a time. Every story is unique but there is always a solution.

What can I do if I can't afford a Lawyer and need to deal with a debt that isn't mine?

Our fees are negotiated with you and depend on your circumstances, which means that your situation may involve a recourse action that entitles you to compensative resolve relating to Advocacy work. All divisions have set rates and packages to suit your needs.

We have a team of lawyers we work with, we are your support.

Do you deal with financial divisions relating to Divorce?

We definitely do! As women we provide experienced based knowledge on how to understand ‘split’ financial procedures. Preparing you for the unknowns you face.

Can you help me with Tax and when my partner has used my details?

Yes, confidential and practical guidance is provided in this situation. We will support you to clear up the matter and regain your identity. We are starting by removing the fear of talking to authorities to protect your assets.

Do you provide guidance about mortgages as well?

Yes, we do! We educate you about the best home loans, mortgages and the process of securing them. We also give credible refinancing advice to pay out your current home loan and take out a new loan through either your existing lender or through a different lender.

Join Our Community

Get to know hundreds of Divas around you, standing strong, making huge progress and supporting their loved ones despite all odds. Hear their stories, share yours and get inspired!

Your Safety is Our Priority

If you or someone you know is experiencing domestic or family violence, call 1800RESPECT (1800 737 732) or visit www.1800RESPECT.org.au.